How to Calculate Tax Offset: A Comprehensive Guide

Calculating tax offset can be a complex task, but with the right knowledge and tools, it becomes manageable. Tax offsets, also known as tax credits, are deductions that reduce the amount of tax you owe to the government. Understanding how to calculate them can lead to significant savings on your tax bill. In this comprehensive guide, we’ll break down the process step by step.

Understanding Tax Offsets

Tax offsets are incentives provided by the government to encourage specific behaviors or to provide relief to certain groups of taxpayers. They can significantly reduce your tax liability, and in some cases, you may even receive a refund if your offsets exceed the amount you owe.

Types of Tax Offsets

Before you can calculate your tax offset, you need to know the different types available. Some common tax offsets include:

- Income Tax Offset: This offset is based on your taxable income and can vary depending on your income level.

- Low and Middle Income Tax Offset (LMITO): LMITO is designed to provide relief to taxpayers with lower to middle incomes.

- Senior Australians and Pensioners Tax Offset (SAPTO): This offset benefits senior citizens and pensioners.

- Small Business Income Tax Offset: Small business owners may be eligible for this offset.

- Franking Credit Offset: This offset applies to shareholders who receive franked dividends.

Calculating Your Tax Offset

The calculation of tax offsets depends on the specific type of offset you are eligible for. Here are some general steps to help you calculate your tax offset:

Step 1: Determine Your Eligibility

Before you calculate any tax offset, make sure you meet the eligibility criteria set by the government. Eligibility criteria can vary widely, so it’s essential to research the specific requirements for the offset you are interested in.

Step 2: Gather the Necessary Information

You’ll need your financial records, including your income statements, expense receipts, and any other relevant documents. Make sure you have accurate and up-to-date information.

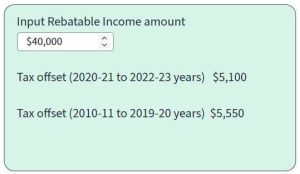

Step 3: Calculate the Offset Amount

The calculation method for each tax offset can be different. Some may be a fixed amount, while others may be a percentage of your eligible expenses or income. Consult the official guidelines or seek assistance from a tax professional to ensure accurate calculations.

Step 4: Apply for the Offset

Once you have calculated the amount of your tax offset, you will need to apply for it when filing your tax return. Ensure that you follow the proper procedures and include all necessary documentation to claim the offset successfully.

Tips for Maximizing Your Tax Offsets

If you want to maximize your tax offsets and reduce your tax liability as much as possible, consider these tips: For celestino tax advisory tax offsetting see here.

- Stay Informed: Keep up to date with changes in tax laws and regulations to take advantage of new offsets or changes in existing ones.

- Keep Records: Maintain organized records of your income, expenses, and any relevant financial transactions throughout the year.

- Seek Professional Advice: Consulting with a tax professional can help you identify all eligible offsets and ensure you’re claiming them correctly.

- Plan Ahead: Strategically plan your finances to maximize your eligibility for specific offsets, such as contributions to retirement accounts or investments in eligible industries.

Conclusion

Calculating tax offsets is an essential part of managing your finances and ensuring you pay only what you owe in taxes. By understanding the types of offsets available, following the proper calculation steps, and staying informed about changes in tax laws, you can make the most of these incentives and reduce your tax burden.

Remember that tax laws can be complex, and it’s always a good idea to seek professional advice when in doubt. With the right approach, you can take full advantage of tax offsets and keep more of your hard-earned money.