What is the Meaning of Payroll Processing?

Payroll processing is a critical aspect of managing a business’s financial operations. It involves the calculation and distribution of employee salaries, wages, and bonuses, along with the deduction of taxes and other withholdings. This comprehensive process ensures that employees are compensated accurately and in compliance with regulatory requirements. Let’s delve into the details of payroll processing and its significance in organizational management.

The Basics of Payroll Processing

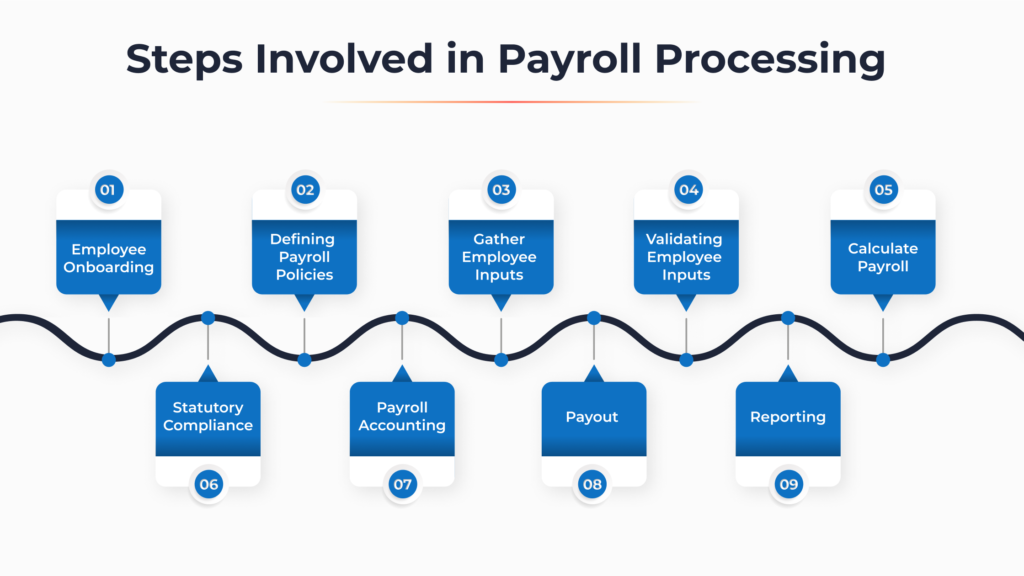

At its core, payroll processing encompasses various tasks related to employee compensation. These tasks include:

- Calculating gross wages based on hours worked or salary agreements

- Applying necessary deductions, such as taxes, insurance, and retirement contributions

- Processing bonuses, overtime pay, and other supplementary payments

- Issuing paychecks or facilitating direct deposits

Efficient payroll processing requires attention to detail and adherence to legal and industry standards. It involves staying updated on tax regulations, benefits administration, and changes in employment laws.

The Importance of Accurate Payroll Processing

Accurate payroll processing is crucial for several reasons:

- Employee Satisfaction: Timely and precise payroll ensures that employees receive their correct compensation, boosting morale and job satisfaction.

- Compliance: Adherence to tax regulations and labor laws is essential to avoid legal issues and penalties.

- Financial Management: Accurate payroll data aids in budgeting and financial planning for the organization.

Additionally, payroll processing contributes to the overall transparency and credibility of an organization, fostering trust between employers and employees. For tax accountants in sydney that do payroll see here.

Automated Payroll Systems

As businesses grow, the complexity of payroll processing increases. Many organizations turn to automated payroll systems to streamline the process and minimize errors. These systems often include features such as:

- Automated tax calculations

- Direct integration with time and attendance systems

- Employee self-service portals

- Compliance tracking and reporting