How much is $120,000 taxed in Australia?

When it comes to understanding the taxation on a $120,000 income in Australia, it’s crucial to navigate through the country’s tax system to ensure compliance and optimize financial planning. This article breaks down the key aspects of taxation for individuals earning $120,000 in Australia. How much is 120k taxed in Australia?

The Australian Tax System Overview

Australia operates on a progressive tax system, where individuals pay higher tax rates as their income increases. The tax rates are subject to change, so it’s essential to refer to the latest information from the Australian Taxation Office (ATO).

Income Tax Rates for $120,000 Earnings

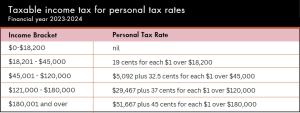

As of the latest available data, the income tax rates for individuals earning $120,000 annually are as follows:

- 0 – $18,200: Taxed at 0%

- $18,201 – $45,000: Taxed at 19%

- $45,001 – $120,000: Taxed at 32.5%

It’s important to note that these rates are applicable for the 2023-2024 financial year, and any changes in tax legislation should be considered for accurate calculations.

Deductions and Tax Offsets

Individuals can reduce their taxable income through various deductions and tax offsets. Common deductions include work-related expenses, charitable donations, and certain investment-related costs. Additionally, tax offsets, such as the Low and Middle Income Tax Offset (LMITO), can further reduce the tax liability for individuals earning $120,000.

Strategies for Tax Optimization

Maximizing deductions, taking advantage of available tax offsets, and considering long-term investments are effective strategies for optimizing tax outcomes. It is advisable to consult with a tax professional to explore personalized options based on individual circumstances.

Superannuation Contributions

Superannuation contributions play a significant role in Australia’s tax landscape. Salary sacrificing into superannuation can result in tax savings, as contributions are taxed at a concessional rate of 15%. Individuals should be mindful of contribution caps and seek advice to ensure compliance.

Understanding Medicare Levy

In addition to income tax, individuals may be subject to the Medicare Levy, which helps fund Australia’s healthcare system. The standard rate is 2% of taxable income, but exemptions and reductions may apply based on specific circumstances.

Conclusion

Managing taxation on a $120,000 income in Australia requires a nuanced understanding of the tax system, available deductions, and strategic financial planning. Staying informed about tax rates, seeking professional advice, and exploring optimization strategies can contribute to a more favorable financial outcome.