Understanding Potential Changes to Tax Rates in 2024

As we approach the new year, many individuals and businesses are eager to know whether there will be any changes to tax rates in 2024. Tax policies can have a significant impact on financial planning and decision-making, making it crucial for taxpayers to stay informed about potential changes. In this article, we’ll explore the latest updates and insights on whether tax rates are set to change in the coming year. Are tax rates changing in 2024?

The Current Tax Landscape

Before delving into potential changes, let’s first take a look at the current tax landscape. As of our latest information cutoff in January 2022, the existing tax rates for individuals and businesses remain in place. However, it’s essential to keep in mind that tax laws are subject to revision, and changes can occur based on economic conditions, legislative decisions, or other factors.

Factors Influencing Potential Changes

Several factors may contribute to changes in tax rates for 2024. Economic conditions, budget considerations, and political decisions can all play a role in shaping tax policies. It’s crucial to monitor these factors to anticipate potential changes and make informed financial decisions.

1. Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can influence tax policy. Governments may adjust tax rates to stimulate economic growth or address fiscal challenges.

2. Legislative Initiatives: Changes to tax rates often result from legislative initiatives. Lawmakers may propose and enact tax reforms to achieve specific policy goals, such as reducing income inequality, promoting investment, or funding government programs.

3. International Developments: Global economic trends and international agreements can also impact domestic tax policies. Countries may adjust their tax rates to remain competitive or comply with international standards.

Recent Proposals and Speculations

While no official announcements have been made regarding changes to tax rates in 2024, there have been speculations and proposals that could influence future tax policies. It’s essential to stay informed about these discussions to anticipate potential adjustments to tax rates.

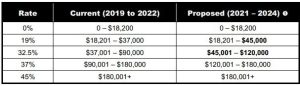

Proposal for Individual Income Tax Changes

There have been discussions about potential changes to individual income tax rates. Some policymakers argue for progressive tax reforms to address income inequality, while others emphasize the importance of maintaining stable tax rates to support economic growth. Keep an eye on legislative developments for any proposed changes to individual income tax brackets and rates.

Corporate Tax Considerations

Businesses should closely monitor discussions related to corporate tax rates. Governments may consider adjustments to corporate taxes to attract foreign investment, stimulate domestic business activity, or fund public infrastructure projects. Changes in corporate tax rates can have a direct impact on a company’s bottom line, influencing profitability and strategic planning.

How to Stay Informed

As we await official announcements regarding tax rates in 2024, individuals and businesses can take proactive steps to stay informed.

Regularly Check Official Government Sources

Government websites and official tax authorities are reliable sources for the latest information on tax rates. Regularly check these sources for updates, announcements, and publications related to tax policies.

1. Internal Revenue Service (IRS): For individuals in the United States, the IRS website is a primary source of information on federal tax policies.

2. Finance Ministries: In many countries, the finance ministry or treasury department is responsible for tax policies. Monitor their official communications for updates on potential tax rate changes.

Consult with Financial Advisors

Financial advisors and tax professionals can provide valuable insights based on their expertise and knowledge of current tax laws. Schedule consultations with professionals to discuss potential changes and how they may impact your specific financial situation.

Conclusion

While the question of whether tax rates will change in 2024 remains unanswered at this point, staying informed and proactive is key to navigating the evolving tax landscape. Keep an eye on economic indicators, legislative initiatives, and official announcements to anticipate and adapt to potential changes in tax policies. By staying informed and consulting with financial experts, individuals and businesses can make well-informed decisions to optimize their financial strategies in the coming year.

Remember, this article provides general information and insights based on the knowledge available up to January 2022. For the most up-to-date information, refer to official government sources and consult with qualified financial professionals.