Managing finances can be a daunting task for many individuals and businesses alike. From balancing books to filing taxes, the responsibilities can often feel overwhelming. However, with proper organization and understanding of the processes involved, you can navigate these tasks with ease. In this guide, we’ll delve into the essentials of balancing books and filing taxes, providing you with actionable insights to streamline your financial management. Balancing Book Filing Taxes

The Importance of Balancing Books

Balancing books is the foundation of sound financial management. It involves reconciling your financial records to ensure accuracy and completeness. By maintaining balanced books, you gain insights into your financial health, identify areas for improvement, and make informed decisions for the future of your business.

Key Steps in Balancing Books:

- Record Keeping: Start by maintaining detailed records of all financial transactions, including income, expenses, assets, and liabilities. Use accounting software or spreadsheets to streamline this process.

- Reconciliation: Regularly reconcile your bank statements with your financial records to identify discrepancies and ensure accuracy. This helps prevent errors and fraudulent activities.

- Budgeting: Develop a budget to track your income and expenses, allocate funds effectively, and avoid overspending. Adjust your budget as needed to reflect changes in your financial situation.

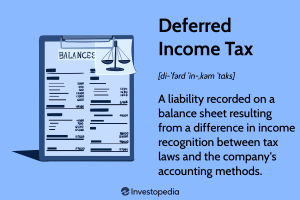

- Financial Analysis: Analyze your financial statements, such as the income statement and balance sheet, to assess your performance and identify trends. This enables you to make data-driven decisions and improve your financial outcomes.

Filing Taxes: Meeting Your Legal Obligations

Filing taxes is a legal requirement for individuals and businesses, and proper compliance is essential to avoid penalties and legal issues. While the process may seem complex, understanding the basics can help simplify the task.

Essential Steps for Filing Taxes:

- Organize Documents: Gather all necessary documents, including W-2 forms, 1099s, receipts, and records of deductible expenses. Having these documents readily available will streamline the tax preparation process.

- Choose the Right Form: Select the appropriate tax form based on your filing status and financial situation. This may include Form 1040 for individuals or various forms for businesses, such as Form 1065 for partnerships and Form 1120 for corporations.

- Calculate Taxes Owed: Use the information gathered to calculate your taxable income and determine the amount of taxes owed. Consider utilizing tax preparation software or seeking assistance from a qualified tax professional for accuracy.

- File on Time: Ensure timely submission of your tax return to avoid late filing penalties. The deadline for filing individual income tax returns in the United States is typically April 15th, though it may vary in certain circumstances.

- Maximize Deductions and Credits: Take advantage of available deductions and credits to minimize your tax liability. This may include deductions for charitable contributions, mortgage interest, and business expenses, as well as tax credits for education expenses and dependent care.

- Review and File: Carefully review your tax return for accuracy before filing. Double-check all entries and calculations to avoid errors that could trigger an audit or delay processing.

By following these steps and maintaining diligence in your financial management practices, you can effectively balance books and file taxes with confidence. Remember to stay informed about changes in tax laws and regulations that may impact your obligations, and seek professional assistance when needed. With a proactive approach to financial management, you can achieve greater stability and success in your personal and professional endeavors.