Understanding the New Tax Tables for July 2023: A Comprehensive Guide

In the ever-evolving landscape of finance and taxation, staying informed about changes in tax regulations is crucial for both individuals and businesses. As we enter the month of July 2023, it’s essential to explore any updates to tax tables that might impact your financial planning. This article aims to provide a detailed overview of the new tax tables for July 2023, offering insights into key changes and their implications.

The Importance of Staying Informed

Keeping abreast of tax updates is not merely a matter of compliance; it directly influences your financial decisions. Whether you are a taxpayer, business owner, or financial advisor, understanding the latest tax tables is paramount for accurate calculations and strategic planning. Let’s delve into the specific changes that have been introduced for July 2023.

Key Changes in Tax Brackets

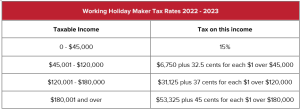

One of the primary aspects of tax tables is the delineation of income into different brackets, each associated with a specific tax rate. In July 2023, there have been adjustments to these brackets, reflecting changes in income thresholds and rates.

The recalibration of tax brackets aims to align with economic trends, inflation rates, and government fiscal policies. Individuals falling within certain income ranges may experience variations in their tax liabilities, either positively or negatively. It is advisable to consult the updated tax tables or seek professional advice to determine how these changes may impact your specific financial situation.

Implications for Businesses

Businesses, both small and large, are significantly affected by alterations in tax regulations. Understanding the new tax tables is crucial for accurate financial forecasting and budgeting. Here are some key points to consider for businesses in light of the July 2023 tax updates:

Corporate Tax Rates

Check whether there have been any adjustments to corporate tax rates. Governments may modify these rates to stimulate economic growth, attract investment, or address fiscal challenges. Businesses should factor these changes into their financial models to ensure accurate tax projections.

Capital Allowances and Deductions

Explore any changes in capital allowances and deductions. Governments may introduce or modify these incentives to encourage specific types of investments or activities. Being aware of such adjustments allows businesses to optimize their tax positions and take advantage of available benefits.

Individual Taxpayers: What You Need to Know

For individual taxpayers, understanding how the new tax tables affect their financial situation is crucial for effective tax planning. Here are key considerations for individuals:

Personal Allowances

Check whether there have been changes to personal allowances. These allowances represent the portion of income that is not subject to taxation. Adjustments to personal allowances can directly impact the amount of income that is taxable.

Tax Credits and Deductions

Explore any new tax credits or deductions introduced in July 2023. Governments may introduce these incentives to promote specific behaviors, such as homeownership, education, or charitable contributions. Understanding and leveraging these credits can significantly reduce an individual’s overall tax liability.