Understanding ATO Tax Rates for 2024

As the new financial year approaches, individuals and businesses are eager to understand the changes in tax rates set by the Australian Taxation Office (ATO) for the year 2024. This article aims to provide a comprehensive overview of the anticipated ATO tax rates and how they may impact taxpayers.

Current ATO Tax Rates

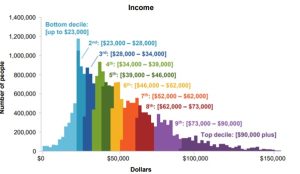

Before delving into the projected rates for 2024, let’s recap the existing tax structure. As of the latest available information, the ATO tax rates for individuals are categorized based on income thresholds:

- Income up to $18,200: Tax rate of 0%

- $18,201 – $45,000: Tax rate of 19%

- $45,001 – $120,000: Tax rate of 32.5%

- $120,001 – $180,000: Tax rate of 37%

- Income above $180,001: Tax rate of 45%

Anticipated Changes for 2024

While official announcements from the ATO are awaited, there are speculations regarding potential changes to the tax rates in the upcoming financial year. These changes may be influenced by economic conditions, government policies, and other factors impacting the fiscal landscape.

Factors Influencing ATO Tax Rate Changes

Several factors can contribute to adjustments in tax rates. These include:

- Economic conditions

- Government fiscal policies

- Global economic trends

- Domestic financial stability

How ATO Tax Changes Impact You

Understanding how potential tax rate changes may affect your financial situation is crucial for effective financial planning. Whether you are an individual taxpayer or a business owner, staying informed about tax rate adjustments enables you to make informed decisions regarding investments, savings, and expenditures.

Preparing for the Changes

Given the uncertainty surrounding future tax rates, it’s prudent to prepare for potential changes. Consult with financial advisors, stay updated on ATO announcements, and assess how modifications in tax rates may align with your financial goals.

Consulting with Financial Professionals

Engaging with financial professionals can provide valuable insights into navigating potential tax changes. They can offer personalized advice based on your financial situation, helping you optimize your tax strategy and minimize liabilities.

Staying Informed

Regularly check official ATO publications, government websites, and reputable financial news sources for the latest updates on tax rates. Staying informed ensures that you are aware of any changes and can adapt your financial plans accordingly.

Conclusion

As the financial year approaches, keeping an eye on potential ATO tax rate changes is essential for sound financial planning. By staying informed, consulting with professionals, and preparing for possible adjustments, individuals and businesses can navigate the evolving fiscal landscape with confidence.