How Do Trust Funds Work in Australia

A trust fund is a powerful financial tool that individuals and families in Australia use for various purposes, including wealth management, estate planning, and asset protection. In this comprehensive guide, we will delve into the intricacies of trust funds in Australia, exploring their functionality, benefits, and legal considerations.

The Basics of Trust Funds

What is a Trust Fund?

A trust fund is a legal entity that holds and manages assets on behalf of one or more beneficiaries. The person who establishes the trust, known as the “settlor,” transfers assets to the trust, and a designated individual or entity, the “trustee,” manages these assets for the benefit of the beneficiaries.

Types of Trust Funds in Australia

There are several types of trust funds commonly used in Australia:

- Family Trusts: These trusts are established to distribute income and capital gains to family members, providing flexibility in tax planning.

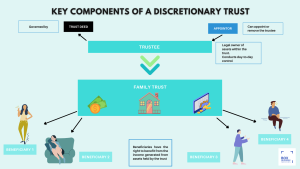

- Discretionary Trusts: Also known as family trusts, these trusts allow the trustee to decide how to distribute income among beneficiaries, providing tax advantages.

- Unit Trusts: In a unit trust, beneficiaries hold “units” similar to shares, and income distribution is based on the number of units held.

Setting Up a Trust Fund in Australia

Legal Requirements:

Setting up a trust fund in Australia involves complying with specific legal requirements. The trust deed, a legal document outlining the trust’s terms and conditions, must be carefully drafted. It should include details about the trustee, beneficiaries, and the purpose of the trust.

Tax Considerations

One of the key benefits of trust funds in Australia is their tax efficiency. Family trusts, for example, allow for income splitting among family members, potentially reducing the overall tax liability. Understanding the tax implications is crucial when establishing and managing a trust fund.

Managing and Administering Trust Funds

Roles and Responsibilities:

The trustee plays a pivotal role in managing the trust fund’s assets and making distributions to beneficiaries. Understanding the legal and financial responsibilities is essential for effective trust fund management.

Legal Compliance and Reporting

Trust funds in Australia are subject to legal and regulatory requirements. Trustees must ensure compliance with tax laws, reporting obligations, and any changes in legislation that may affect the trust. Staying informed and seeking professional advice is crucial to avoid legal complications.

Benefits of Trust Funds in Australia

Asset Protection:

Trust funds provide a layer of protection for assets, shielding them from potential legal claims and creditors. This is particularly beneficial for individuals looking to safeguard family wealth and assets.

Flexibility and Control

Trustees have the flexibility to manage and distribute assets according to the trust deed’s provisions. This flexibility allows for effective estate planning, wealth transfer, and tax optimization based on changing circumstances.

Conclusion

In conclusion, trust funds are valuable financial instruments in Australia, offering a range of benefits for individuals and families. Understanding the legal requirements, tax implications, and proper management practices is essential for harnessing the full potential of trust funds. Consultation with legal and financial professionals is advisable to ensure compliance and optimize the use of trust funds in your specific financial situation.