What Time Does ATO Process Refund? A Comprehensive Guide

Introduction

When it comes to tax season, one of the most eagerly anticipated moments for many Australians is the arrival of their tax refund from the Australian Taxation Office (ATO). However, the timing of when the ATO processes refunds can be a mystery to many. In this comprehensive guide, we will delve into the details of when you can expect your tax refund and what factors may influence the processing time. What time does ATO process refund?

Understanding ATO Refunds

Before we dive into the specific timing of ATO refunds, it’s essential to understand the basics. A tax refund is the excess amount of money that you have paid to the ATO throughout the financial year. This surplus is returned to you after you file your tax return. The processing time for ATO refunds can vary depending on several factors.

Factors Influencing Refund Processing Time

Several factors can influence how quickly the ATO processes your tax refund:

1. Lodgment Date

The date you lodge your tax return can significantly impact the processing time. Typically, the ATO begins processing tax returns in early July for the previous financial year. The earlier you file your return, the sooner you can expect your refund. Electronic lodgment is generally faster than paper lodgment.

2. Completeness and Accuracy

The accuracy and completeness of your tax return can affect processing time. Errors or missing information may result in delays as the ATO may need to request additional documentation or clarification.

3. Complexity of Your Return

If your tax return is more complex due to various income sources, deductions, or tax offsets, it may take longer to process. Complex returns often require more extensive review by ATO staff.

4. ATO Workload

The ATO’s workload during the tax season can impact processing times. High volumes of returns may lead to delays in processing. Monitoring the ATO’s updates and announcements can provide insights into potential delays.

Typical ATO Refund Processing Times

While the exact processing time can vary, the ATO provides general guidelines for when you can expect your refund:

1. Electronically Lodged Returns

If you have lodged your tax return electronically, you can generally expect your refund within two weeks of lodging. However, this timeline may be longer during peak tax season or if there are issues with your return.

2. Paper Lodged Returns

Paper lodgments typically take longer to process. You may need to wait up to 10 weeks or more to receive your refund if you filed your return on paper. This method is less common today due to the efficiency of electronic lodgment.

3. Delayed Refunds

In some cases, your refund may be delayed. This can occur if the ATO needs to review your return more thoroughly, if there are discrepancies, or if you owe money to other government agencies or departments. If your refund is delayed, the ATO will notify you and provide information on the reasons for the delay.

Checking the Status of Your Refund

To track the status of your tax refund, you can use the ATO’s online services. Here’s how:

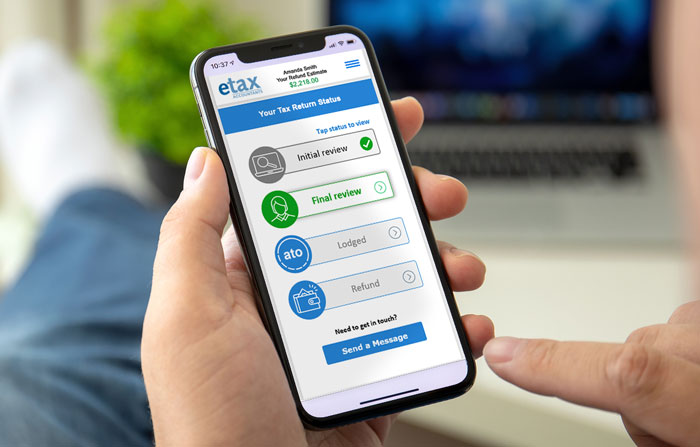

1. MyGov Account

If you have linked your MyGov account to the ATO, you can log in and check the status of your refund. The ATO updates this information regularly.

2. ATO Online Services

You can also access the ATO’s online services directly through their website. Simply log in, and you can view the progress of your return and refund.

3. Automated Phone Service

If you prefer to check by phone, you can use the ATO’s automated phone service. Follow the prompts to inquire about the status of your refund.

Conclusion

In conclusion, the timing of when the ATO processes your refund depends on several factors, including when you lodge your return, its accuracy, complexity, and the ATO’s workload. Typically, electronic lodgment results in faster processing times, while paper lodgment may lead to delays. If you’re eager to receive your refund promptly, ensure that your tax return is accurate and complete. By using the ATO’s online services, you can easily track the progress of your refund and stay informed about any potential delays. Remember that patience is key during tax season, as processing times can vary, but rest assured that the ATO is working diligently to process refunds as efficiently as possible. See our services for more information.