How to Offset Tax in Australia: A Comprehensive Guide

When it comes to managing your finances, one key aspect to consider is how to offset tax in Australia. Understanding the various tax offset strategies available can help you minimize your tax liability and maximize your savings. In this guide, we’ll explore different ways to offset tax in Australia, from claiming deductions to utilizing tax offsets and credits.

1. Claiming Deductions

Deductions are a fundamental way to reduce your taxable income, ultimately lowering the amount of tax you owe. Here are some common deductions you can consider:

Work-Related Expenses

If you incur expenses related to your job, such as work-related travel, uniforms, or self-education, you may be eligible to claim these as deductions on your tax return. Keep detailed records and receipts to support your claims.

Investment Property Expenses

If you own an investment property, you can claim deductions for expenses like mortgage interest, property management fees, and repairs and maintenance. Be sure to comply with tax laws and regulations regarding investment properties.

2. Utilizing Tax Offsets and Credits

Tax offsets and credits are another effective way to reduce your tax liability. Here are some notable options:

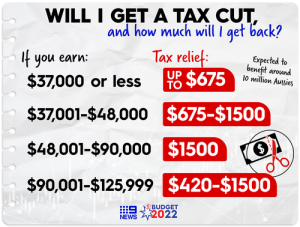

Low and Middle Income Tax Offset (LMITO)

LMITO provides tax relief for individuals with taxable incomes within a specific range. It can reduce the amount of tax you owe, and in some cases, you may receive a refund if the offset exceeds your tax liability.

Senior and Pensioner Tax Offset (SAPTO)

If you are a senior or eligible pensioner, SAPTO can provide significant tax relief. It’s designed to reduce or eliminate the tax payable on your income, ensuring financial security in retirement.

3. Superannuation Strategies

Superannuation is a crucial part of retirement planning in Australia. By utilizing superannuation strategies, you can minimize your taxable income while building a comfortable retirement nest egg.

Salary Sacrifice

Consider salary sacrificing a portion of your pre-tax income into your superannuation account. This can reduce your taxable income while boosting your retirement savings.

Government Co-contributions

If you are eligible, the government may contribute money to your superannuation account through the co-contribution scheme. This can be an effective way to bolster your retirement savings. Learn how to offset tax here.

4. Seek Professional Advice

While these strategies can help you offset tax in Australia, tax laws and regulations are complex and subject to change. To ensure you are making the most of available opportunities and staying compliant, it’s wise to seek advice from a qualified tax professional or financial advisor.

In conclusion, understanding how to offset tax in Australia involves a combination of claiming deductions, utilizing tax offsets and credits, and implementing smart superannuation strategies. By carefully managing your finances and staying informed about tax laws, you can optimize your tax position and achieve your financial goals.